Wednesday, February 12, 2014

Saturday, October 12, 2013

Lou Simpson's 5 Investing Principles

I was consolidating some stuff from an old hard drive and ran across this document. I really can't say where it came from, and I was unable to find the 1986 Geico Annual Report online. I did verify these comments in a later Geico Annual letter that was in the SEC here. It's a simple and concise summation of Simpson's investment style.

Thursday, April 18, 2013

East Coast Asset Management Q1 2013 Quarterly letter.

Christopher Begg's letters are some of the most insightful investment reads around. I am always impressed at the parallels derived from science, art, and nature and then applied to sound investing. Over the last few letters, Begg has in great detail described the investing methods used at his firm. I think it wise to take note.

Were you able to figure out what stock Begg described at the end of the letter?

Were you able to figure out what stock Begg described at the end of the letter?

|

| Johann Sebastian Bach |

Friday, April 12, 2013

Recent Don Yacktman interview with Steve Forbes

Don Yacktman is plain vanilla value investing with a healthy side order of patience. His slow and steady approach has served them well performance-wise coming in #1 in the 5, 10, and 15 year time spans in the Large Blend category according to Morningstar. Here Yacktman talks with Steve Forbes about how he views the current investment environment and touches on a couple of the funds holdings. Yacktman's demeanor exudes patience and calm.

Sunday, April 7, 2013

The Vinyl Market and it's Invisible Hand

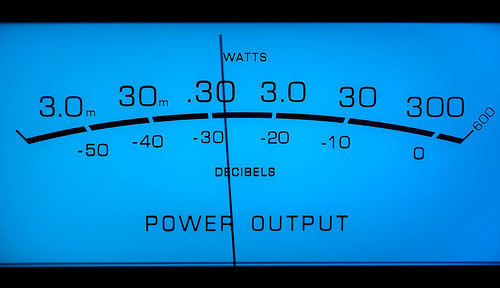

This blog is called Money in Stereo, and as I've said, those are two things I'm passionate about. I enjoy learning all I can about Value Investing, and as an ex-sound engineer, I have a passion for music, especially on Vinyl. I've been building my collection of records for about seven years, and it is an affliction that only gets worse...or better depending on how you look at it. Over the years I could not help but observe the nuances of the vinyl market place and its similarities to the stock market.

Over a series of posts, I want to start examining some attributes of the vinyl market place as it applies to investing. For the sake of brevity and readability, there are several areas where I will write with broad strokes, or leave some questions to the imagination. The macro mavens might want to know not just about the vinyl marketplace, but rather why the vinyl market has had such a pronounced upswing. There is the hotly debated question of whether records sound better than CD's and other digital formats? (hint: Of course analogue sounds better! See - I've made some enemies already.) Why compromise convenience and portability just to hear a record which cannot easily shuffle from song to song, that crackles, and needs to be manually flipped over to continue listening? I am going to leave those questions alone for now.

How in the heck can buying LP's be like buying stocks?

Let's start at the beginning.

Records on Vinyl were the medium of choice in most of the 1900's. In the 1970's, in a move to reduce costs, record labels began issuing vinyl that was 70% virgin / 30% recycled vinyl. These records were thin and light weight, and unfortunately not as durable. If you've thumbed thru your parent's collection, or if you grew up in the 70's, these are probably the type of records that are at your house collecting dust. Often, the years have not been kind to these records, and I typically find the sound quality 'thin' and lacking, thus enter the current Replacement Cycle as vinyl has been rediscovered.

|

| Back to Black In America vinyl sales are running 39% above last year's level |

With the advent of the CD and MP3, the digital age of music and it's amazing portability was and is upon us, however in 2008, as seen in the chart above, vinyl purchases soared. I am not terribly sure as to why, but I have a feeling that it correlates with the gradual gravitation towards quality over quantity that has been taking place in most major metropolitan areas. I find that trend also observable in the cocktails, craft beers, and gourmet burgers that have saturated LA and NYC and now making their way to the interior of America.

Buying Binge

I began buying records about seven years ago. As a musician and former sound engineer, it came natural to seek out Vinyl to truly immerse myself in the sonic experience. I often paid a pretty penny for albums that I thought would sound good on vinyl. One that comes to mind is Marilyn Manson: Antichrist Superstar.

This is an album that I got a lot out of in my angst-riddled youth growing up in Nowheresville, LA. I thought back to how it sounded on headphones. I remember all the different layers of sounds and distortions, the subtle warbling chorus effects, the multi-tracked vocals, the various colors it envoked and the blistering performances that were conveyed on that album. (Warning - that record is not for the faint of heart. It has its time and place.) I searched fervently for the vinyl, but my weekly trips to Amoeba bared no fruit. Like Buffett and the IBM annual report, I knew the album backwards and forwards, so when I found it at what I deemed to be a reasonable price, I had no hesitation in making the purchase.

I bought Antichrist Superstar at Amoeba for $60.00 pre-tax. I rushed home, and dropped the needle with my Grado 225i Headphones on the ears. The guitar screeched and grinded more vividly than ever. It was as if I was hearing the album for the first time, and I instantly knew it was money well spent. I was happy with the purchase, and had no plans to sell...until I checked eBay and Amazon one day out of curiosity. The album now has an asking price of $150. That is crazy, right? Well, yes and no. To folks who don't care about music, of course its crazy. To people who love music, it can be frustrating, because some of your favorite records may be out of reach. The price is a function of a number of different things just as in the equity market.

1. Buy businesses that you understand within your circle of competence.

Thanks to my previous line of work, I can hear an album and immediately break each song into separate instruments, hearing them independently in both function and form within the song, get a quick understanding of equalization, compression and reverb/delay effects that are employed. I can tell if an album has been compressed to hell-and-back and chopped up in a computer, or recorded thru more traditional analogue methods in an attempt to retain the sonic integrity of the individual instruments. I can hear if the bass player uses a pick or his fingers. I like to make note of the song structures, when different instruments are layered atop each other, and where each instrument sits in the stereo spectrum. These are all things anyone can do if they just pay attention, and I often feel that I can see better with my eyes closed.

Given the above, I know that certain albums will sound special when they are on vinyl, and interestingly enough, often these albums are priced as such. Similar to a great business like Mastercard or Coke, at 25x and 20x earnings, they are priced accordingly. Sonically, Bob Dylan's "Time out of Mind" has long been one of my favorite albums with amazing low end, sparse instrumentation (Less is More!), brillant stereo spacing, and of course Bob Dylan's profoundly human lyrics. The vinyl market knows its a killer record and it's commanding a $250 price tag!!! I would say the same thing about Cake's "Fashion Nugget" sans the 'profoundly human lyrics'.

2. Buy a great company at a fair price

With Anti-Christ Superstar, I bought what I believed to be a sonically superior record that I would be happy to own, regardless of whether its price (perceived value) went up or down on the open market. eBay and Amoeba records could close for five years and it wouldn't matter, because I knew it was a great record that would continue to deliver a consistent stream of returns, which in my case is musical enjoyment. This closely echoes Buffett when he says he does not care if the stock market close for 5 years, as long as the company's moat and intrinsic value are expanding, he does not care what the market price of the stock is.

|

| The Lonesome Crowded West |

3. Number of shares outstanding

In the vein of 'shares outstanding', vinyl pressings of certain albums simply do not exist in large quantities. As the amount of available records (float) dwindles, those that want in have to pay a continually higher price. I took a pass on Modest Mouse's Lonesome Crowded West LP around $100 a couple years ago which has since proved to be a mistake. Where do you draw the line? Is this record worth 25x earnings? Album Price / # of Tracks = Price to Rocking Ratio??? See the two previous items above. Before you buy a $250 record, be sure you know the album intimately. Be sure you don't care if the price of the album continues to go up or down after you buy it. It's like a piece of art - buy it because you really want it, not because you're speculating that it will go up in price. That also echoes Buffet's and Robert Schiller's recent comments on owning a home!

The prices of records can most certainly go down. Past performance not necessarily indicative of future results. In my mind, it is called Dilution, but in the vinyl market it is called the Re-issue.

In the future, I will highlight some unfortunate cases of vinyl dilution, pre-mature accumulation, and vinyl arbitrage. I've added a couple things on the music page. That page changes and reflects whatever I may be listening to at the time.

The Destination is the Journey. Maybe.

Subscribe to:

Posts (Atom)